Page 527 - Ebook HTKH 2024

P. 527

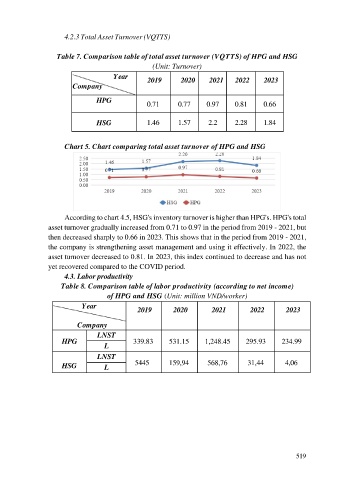

4.2.3 Total Asset Turnover (VQTTS)

Table 7. Comparison table of total asset turnover (VQTTS) of HPG and HSG

(Unit: Turnover)

Year 2019 2020 2021 2022 2023

Company

HPG

0.71 0.77 0.97 0.81 0.66

HSG 1.46 1.57 2.2 2.28 1.84

Chart 5. Chart comparing total asset turnover of HPG and HSG

According to chart 4.5, HSG's inventory turnover is higher than HPG's. HPG's total

asset turnover gradually increased from 0.71 to 0.97 in the period from 2019 - 2021, but

then decreased sharply to 0.66 in 2023. This shows that in the period from 2019 - 2021,

the company is strengthening asset management and using it effectively. In 2022, the

asset turnover decreased to 0.81. In 2023, this index continued to decrease and has not

yet recovered compared to the COVID period.

4.3. Labor productivity

Table 8. Comparison table of labor productivity (according to net income)

of HPG and HSG (Unit: million VND/worker)

Year 2019 2020 2021 2022 2023

Company

LNST

HPG 339.83 531.15 1,248.45 295.93 234.99

L

LNST

HSG L 5445 159,94 568,76 31,44 4,06

519