Page 525 - Ebook HTKH 2024

P. 525

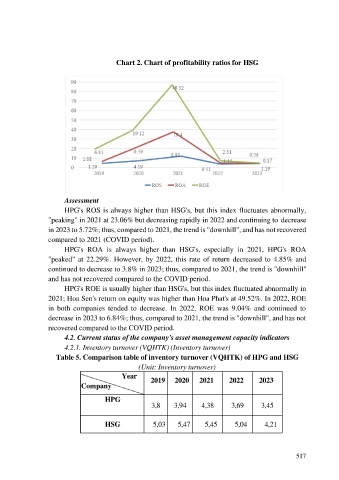

Chart 2. Chart of profitability ratios for HSG

Assessment

HPG's ROS is always higher than HSG's, but this index fluctuates abnormally,

"peaking" in 2021 at 23.06% but decreasing rapidly in 2022 and continuing to decrease

in 2023 to 5.72%; thus, compared to 2021, the trend is "downhill", and has not recovered

compared to 2021 (COVID period).

HPG's ROA is always higher than HSG's, especially in 2021, HPG's ROA

"peaked" at 22.29%. However, by 2022, this rate of return decreased to 4.85% and

continued to decrease to 3.8% in 2023; thus, compared to 2021, the trend is "downhill"

and has not recovered compared to the COVID period.

HPG's ROE is usually higher than HSG's, but this index fluctuated abnormally in

2021; Hoa Sen's return on equity was higher than Hoa Phat's at 49.52%. In 2022, ROE

in both companies tended to decrease. In 2022, ROE was 9.04% and continued to

decrease in 2023 to 6.84%; thus, compared to 2021, the trend is "downhill", and has not

recovered compared to the COVID period.

4.2. Current status of the company's asset management capacity indicators

4.2.1. Inventory turnover (VQHTK) (Inventory turnover)

Table 5. Comparison table of inventory turnover (VQHTK) of HPG and HSG

(Unit: Inventory turnover)

Year 2019 2020 2021 2022 2023

Company

HPG

3,8 3,94 4,38 3,69 3,45

HSG 5,03 5,47 5,45 5,04 4,21

517