Page 387 - Ebook HTKH 2024

P. 387

an effective internal audit function regarding ESG which fulfills its competency 172

including professionalism, performance, environment, leadership, and communication.

2. Literature review

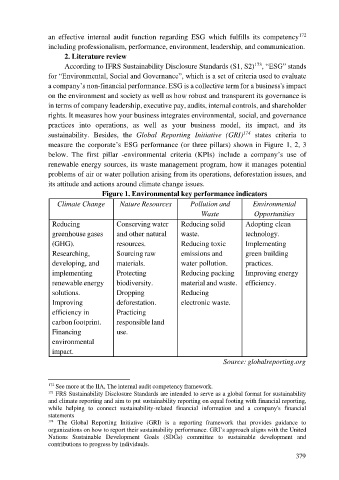

According to IFRS Sustainability Disclosure Standards (S1, S2) 173 , “ESG” stands

for “Environmental, Social and Governance”, which is a set of criteria used to evaluate

a company’s non-financial performance. ESG is a collective term for a business's impact

on the environment and society as well as how robust and transparent its governance is

in terms of company leadership, executive pay, audits, internal controls, and shareholder

rights. It measures how your business integrates environmental, social, and governance

practices into operations, as well as your business model, its impact, and its

sustainability. Besides, the Global Reporting Initiative (GRI) 174 states criteria to

measure the corporate’s ESG performance (or three pillars) shown in Figure 1, 2, 3

below. The first pillar -environmental criteria (KPIs) include a company’s use of

renewable energy sources, its waste management program, how it manages potential

problems of air or water pollution arising from its operations, deforestation issues, and

its attitude and actions around climate change issues.

Figure 1. Environmental key performance indicators

Climate Change Nature Resources Pollution and Environmental

Waste Opportunities

Reducing Conserving water Reducing solid Adopting clean

greenhouse gases and other natural waste. technology.

(GHG). resources. Reducing toxic Implementing

Researching, Sourcing raw emissions and green building

developing, and materials. water pollution. practices.

implementing Protecting Reducing packing Improving energy

renewable energy biodiversity. material and waste. efficiency.

solutions. Dropping Reducing

Improving deforestation. electronic waste.

efficiency in Practicing

carbon footprint. responsible land

Financing use.

environmental

impact.

Source: globalreporting.org

172 See more at the IIA, The internal audit competency framework.

173 FRS Sustainability Disclosure Standards are intended to serve as a global format for sustainability

and climate reporting and aim to put sustainability reporting on equal footing with financial reporting,

while helping to connect sustainability-related financial information and a company's financial

statements

174 The Global Reporting Initiative (GRI) is a reporting framework that provides guidance to

organizations on how to report their sustainability performance. GRI’s approach aligns with the United

Nations Sustainable Development Goals (SDGs) committee to sustainable development and

contributions to progress by individuals.

379