Page 376 - Ebook HTKH 2024

P. 376

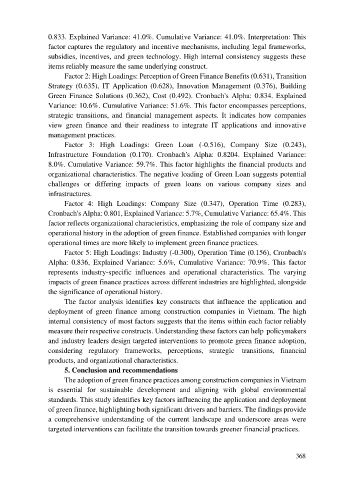

0.833. Explained Variance: 41.0%. Cumulative Variance: 41.0%. Interpretation: This

factor captures the regulatory and incentive mechanisms, including legal frameworks,

subsidies, incentives, and green technology. High internal consistency suggests these

items reliably measure the same underlying construct.

Factor 2: High Loadings: Perception of Green Finance Benefits (0.631), Transition

Strategy (0.635), IT Application (0.628), Innovation Management (0.376), Building

Green Finance Solutions (0.362), Cost (0.492). Cronbach's Alpha: 0.834. Explained

Variance: 10.6%. Cumulative Variance: 51.6%. This factor encompasses perceptions,

strategic transitions, and financial management aspects. It indicates how companies

view green finance and their readiness to integrate IT applications and innovative

management practices.

Factor 3: High Loadings: Green Loan (-0.516), Company Size (0.243),

Infrastructure Foundation (0.170). Cronbach's Alpha: 0.8204. Explained Variance:

8.0%. Cumulative Variance: 59.7%. This factor highlights the financial products and

organizational characteristics. The negative loading of Green Loan suggests potential

challenges or differing impacts of green loans on various company sizes and

infrastructures.

Factor 4: High Loadings: Company Size (0.347), Operation Time (0.283),

Cronbach's Alpha: 0.801, Explained Variance: 5.7%, Cumulative Variance: 65.4%. This

factor reflects organizational characteristics, emphasizing the role of company size and

operational history in the adoption of green finance. Established companies with longer

operational times are more likely to implement green finance practices.

Factor 5: High Loadings: Industry (-0.300), Operation Time (0.156), Cronbach's

Alpha: 0.836, Explained Variance: 5.6%, Cumulative Variance: 70.9%. This factor

represents industry-specific influences and operational characteristics. The varying

impacts of green finance practices across different industries are highlighted, alongside

the significance of operational history.

The factor analysis identifies key constructs that influence the application and

deployment of green finance among construction companies in Vietnam. The high

internal consistency of most factors suggests that the items within each factor reliably

measure their respective constructs. Understanding these factors can help policymakers

and industry leaders design targeted interventions to promote green finance adoption,

considering regulatory frameworks, perceptions, strategic transitions, financial

products, and organizational characteristics.

5. Conclusion and recommendations

The adoption of green finance practices among construction companies in Vietnam

is essential for sustainable development and aligning with global environmental

standards. This study identifies key factors influencing the application and deployment

of green finance, highlighting both significant drivers and barriers. The findings provide

a comprehensive understanding of the current landscape and underscore areas were

targeted interventions can facilitate the transition towards greener financial practices.

368