Page 263 - Ebook HTKH 2024

P. 263

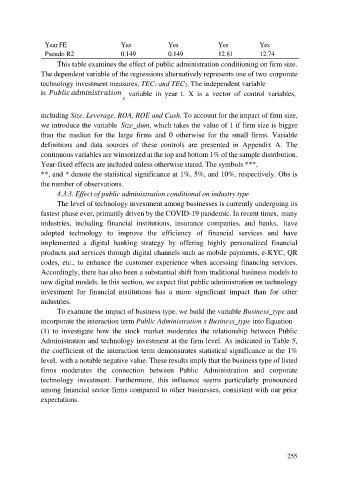

Year FE Yes Yes Yes Yes

Pseudo R2 0.149 0.149 12.81 12.74

This table examines the effect of public administration conditioning on firm size.

The dependent variable of the regressions alternatively represents one of two corporate

technology investment measures, TEC1 and TEC2. The independent variable

is variable in year t. X is a vector of control variables,

including Size, Leverage, ROA, ROE and Cash. To account for the impact of firm size,

we introduce the variable Size_dum, which takes the value of 1 if firm size is bigger

than the median for the large firms and 0 otherwise for the small firms. Variable

definitions and data sources of these controls are presented in Appendix A. The

continuous variables are winsorized at the top and bottom 1% of the sample distribution.

Year-fixed effects are included unless otherwise stated. The symbols ***,

**, and * denote the statistical significance at 1%, 5%, and 10%, respectively. Obs is

the number of observations.

4.3.3. Effect of public administration conditional on industry type

The level of technology investment among businesses is currently undergoing its

fastest phase ever, primarily driven by the COVID-19 pandemic. In recent times, many

industries, including financial institutions, insurance companies, and banks, have

adopted technology to improve the efficiency of financial services and have

implemented a digital banking strategy by offering highly personalized financial

products and services through digital channels such as mobile payments, e-KYC, QR

codes, etc., to enhance the customer experience when accessing financing services.

Accordingly, there has also been a substantial shift from traditional business models to

new digital models. In this section, we expect that public administration on technology

investment for financial institutions has a more significant impact than for other

industries.

To examine the impact of business type, we build the variable Business_type and

incorporate the interaction term Public Administration x Business_type into Equation

(1) to investigate how the stock market moderates the relationship between Public

Administration and technology investment at the firm level. As indicated in Table 5,

the coefficient of the interaction term demonstrates statistical significance at the 1%

level, with a notable negative value. These results imply that the business type of listed

firms moderates the connection between Public Administration and corporate

technology investment. Furthermore, this influence seems particularly pronounced

among financial sector firms compared to other businesses, consistent with our prior

expectations.

255