Page 346 - Ebook HTKH 2024

P. 346

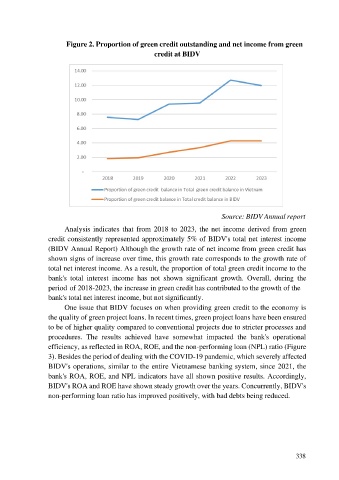

Figure 2. Proportion of green credit outstanding and net income from green

credit at BIDV

Source: BIDV Annual report

Analysis indicates that from 2018 to 2023, the net income derived from green

credit consistently represented approximately 5% of BIDV's total net interest income

(BIDV Annual Report) Although the growth rate of net income from green credit has

shown signs of increase over time, this growth rate corresponds to the growth rate of

total net interest income. As a result, the proportion of total green credit income to the

bank's total interest income has not shown significant growth. Overall, during the

period of 2018-2023, the increase in green credit has contributed to the growth of the

bank's total net interest income, but not significantly.

One issue that BIDV focuses on when providing green credit to the economy is

the quality of green project loans. In recent times, green project loans have been ensured

to be of higher quality compared to conventional projects due to stricter processes and

procedures. The results achieved have somewhat impacted the bank's operational

efficiency, as reflected in ROA, ROE, and the non-performing loan (NPL) ratio (Figure

3). Besides the period of dealing with the COVID-19 pandemic, which severely affected

BIDV's operations, similar to the entire Vietnamese banking system, since 2021, the

bank's ROA, ROE, and NPL indicators have all shown positive results. Accordingly,

BIDV's ROA and ROE have shown steady growth over the years. Concurrently, BIDV's

non-performing loan ratio has improved positively, with bad debts being reduced.

338