Page 345 - Ebook HTKH 2024

P. 345

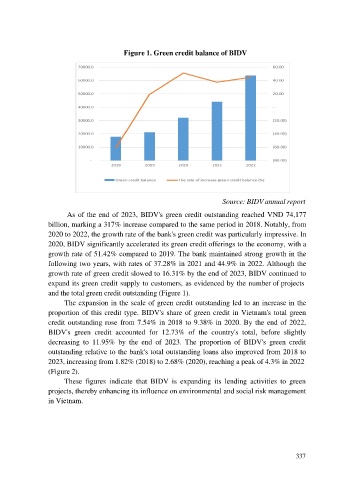

Figure 1. Green credit balance of BIDV

Source: BIDV annual report

As of the end of 2023, BIDV's green credit outstanding reached VND 74,177

billion, marking a 317% increase compared to the same period in 2018. Notably, from

2020 to 2022, the growth rate of the bank's green credit was particularly impressive. In

2020, BIDV significantly accelerated its green credit offerings to the economy, with a

growth rate of 51.42% compared to 2019. The bank maintained strong growth in the

following two years, with rates of 37.28% in 2021 and 44.9% in 2022. Although the

growth rate of green credit slowed to 16.31% by the end of 2023, BIDV continued to

expand its green credit supply to customers, as evidenced by the number of projects

and the total green credit outstanding (Figure 1).

The expansion in the scale of green credit outstanding led to an increase in the

proportion of this credit type. BIDV's share of green credit in Vietnam's total green

credit outstanding rose from 7.54% in 2018 to 9.38% in 2020. By the end of 2022,

BIDV's green credit accounted for 12.73% of the country's total, before slightly

decreasing to 11.95% by the end of 2023. The proportion of BIDV's green credit

outstanding relative to the bank's total outstanding loans also improved from 2018 to

2023, increasing from 1.82% (2018) to 2.68% (2020), reaching a peak of 4.3% in 2022

(Figure 2).

These figures indicate that BIDV is expanding its lending activities to green

projects, thereby enhancing its influence on environmental and social risk management

in Vietnam.

337