Page 338 - Ebook HTKH 2024

P. 338

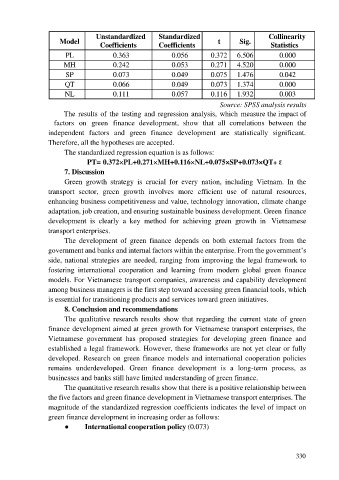

Unstandardized Standardized Collinearity

Model t Sig.

Coefficients Coefficients Statistics

PL 0.363 0.056 0.372 6.506 0.000

MH 0.242 0.053 0.271 4.520 0.000

SP 0.073 0.049 0.075 1.476 0.042

QT 0.066 0.049 0.073 1.374 0.000

NL 0.111 0.057 0.116 1.932 0.003

Source: SPSS analysis results

The results of the testing and regression analysis, which measure the impact of

factors on green finance development, show that all correlations between the

independent factors and green finance development are statistically significant.

Therefore, all the hypotheses are accepted.

The standardized regression equation is as follows:

PT= 0.372×PL+0.271×MH+0.116×NL+0.075×SP+0.073×QT+ Ɛ

7. Discussion

Green growth strategy is crucial for every nation, including Vietnam. In the

transport sector, green growth involves more efficient use of natural resources,

enhancing business competitiveness and value, technology innovation, climate change

adaptation, job creation, and ensuring sustainable business development. Green finance

development is clearly a key method for achieving green growth in Vietnamese

transport enterprises.

The development of green finance depends on both external factors from the

government and banks and internal factors within the enterprise. From the government’s

side, national strategies are needed, ranging from improving the legal framework to

fostering international cooperation and learning from modern global green finance

models. For Vietnamese transport companies, awareness and capability development

among business managers is the first step toward accessing green financial tools, which

is essential for transitioning products and services toward green initiatives.

8. Conclusion and recommendations

The qualitative research results show that regarding the current state of green

finance development aimed at green growth for Vietnamese transport enterprises, the

Vietnamese government has proposed strategies for developing green finance and

established a legal framework. However, these frameworks are not yet clear or fully

developed. Research on green finance models and international cooperation policies

remains underdeveloped. Green finance development is a long-term process, as

businesses and banks still have limited understanding of green finance.

The quantitative research results show that there is a positive relationship between

the five factors and green finance development in Vietnamese transport enterprises. The

magnitude of the standardized regression coefficients indicates the level of impact on

green finance development in increasing order as follows:

● International cooperation policy (0.073)

330